city of cincinnati tax abatement

The tax abatement allows residents and businesses to have a portion of their property taxes abated based on the improved value of their investment into a specific property. Tax rates vary slightly depending on location this calculator is for illustration purposes only.

The original green building tax abatement ordinance was passed in 2006 and has been amended four times since culminating in the current abatement rules clarifications passed December 19 2012.

. Adjust the land value and structure. In a rare move Monday Cincinnati City Council voted not to approve a recommended tax abatement for a commercial development. All City Series residences are eligible for the City of Cincinnati Community Reinvestment Area CRA Residential Tax Abatement program which enables property owners to significantly minimize the real estate taxes they pay.

This calculator assumes a 258 tax rate a 4 interest rate and a 30-year loan. Cincinnati Income Tax Division representatives are available to assist taxpayers during business hours. Form fr 7141 miami avenue cincinnati oh 45243 city of madeira tax office make check or money order to.

Tax Abatement Program 805 Central Avenue Suite 700 Cincinnati Ohio 45202 For further program information please call. 805 Central Avenue Suite 600 Cincinnati OH 45202. Applicants who are renovating existing residential structures must pay an application fee of 25000 which may be paid by check to the City of Cincinnati.

Property tax abatement is available for any increased valuation that results from improvements to the property for new. Tax abatement doesnt mean that youre completely exempt from paying taxes. Essentially if you renovate or build a home in the City of Cincinnati you have the opportunity to pay less in taxes if you follow certain criteria.

The City of Cincinnatis Residential Property Tax Abatement makes it possible for property owners to minimize the taxes they pay. 446 Milton St Cincinnati OH 45202. Book Page Parcel Tax abatement program staff will verify cost and completion date.

Tax Abatement - Cincinnati OH Real Estate. To apply for the CRA Tax Abatement Program applicants will need to submit an application to the City of Cincinnati Department of Economic Development. The Cincinnati Residential Tax Abatement program minimizes property owners taxes by allowing them to pay taxes on the pre-improvement value of their property for 10-15 years.

Overhaul of terrible tax abatement program needed. City of Cincinnati- Residential Tax Abatements Tyler Data Insights. Property tax abatement is available for any increased valuation that results from improvements to the property for new construction and.

When you build a new home or invest in renovations your property taxes can go up. Call Customer Service 513-352-3838 for Individual Accounts. With a new City Council ready to emerge later this year residents are curious to see what kind of changes lie ahead for Cincinnati.

The new Cincinnati tax abatement plan was created to stimulate home buying and home building within the community. The tax abatement allows residents and businesses to have a portion of their property taxes abated based on the improved value of their investment into a specific property. The City of Cincinnatis Residential Property Tax Abatement allows owners to pay taxes on the pre-improvement value of their property for 10-15 years.

The Cincinnati Income Tax Division is located at. 513-352-3847 for Business and Payroll Withholding Accounts. 513 352-5352 FOR OFFICIAL USE ONLY Legal description of property location.

City of cincinnati tax forms. City administration proposed an eight-year abatement for a Swensons. City of Cincinnati Department of Community and Economic Development Residential Tax Abatement Program 805 Central Avenue Suite 700 Cincinnati Ohio 45202 For further information please contact Matthew Heldman.

The City of Cincinnati government is dedicated to maintaining the highest quality of life for the people of Cincinnati. The Cincinnati Community Reinvestment Area CRA Residential Tax Abatement as its called offers property owners the ability to minimize their tax implications. You would only pay on the amount of pre-improvement value up to certain levels.

Essentially if you renovate or build a home in the City of Cincinnati you have the opportunity to pay less in taxes if you follow certain criteria. This means that any improvements will NOT significantly add to your property tax bill. When you build a new home or invest in renovations your property taxes can go up.

The Abatement allows owners to pay taxes just on the pre-improvement value of their. 513 352-4648 or e-mail MatthewHeldmancincinnati-ohgov. All cincinnati residents who receive taxable compensation are required to pay the city of cincinnati income tax at the rate of 21 thru 100120 and 18 effective 100220.

Hamilton County agreed to contribute an amount equal to the property taxes foregone by exemptions offered on the new stadium properties then estimated to be around 5 million per year. However the reduction in payment is very significant. The 1999 Tax Abatement Agreement took effect when the city and Hamilton County were planning construction of two sports stadiums on Cincinnatis riverfront.

City of Cincinnati Community Reinvestment Area CRA Residential Tax Abatement. Property tax abatement is available for any increased valuation that results from improvements to the property for new construction and renovation. The Wage Theft Protected dashboard displays all projects that are covered by the City of Cincinnatis Wage Enforcement ordinance that ensures that any development incentivized through a Community Reinvestment Area tax abatement job creation tax credits commercial loan conveyance of land for less than fair market value tax increment financing or grants valued at.

The City of Cincinnati offers property tax abatements for residential and commercial buildings constructed or renovated to meet LEED certification standards. Use our tax abatement calculator to find out what you could save in property taxes by building a LEED-certified home in the city of Cincinnati. The City is focused on economic development to create jobs committed to innovation and efficiency through technology seeks to be a leader in environmental sustainability and pursues partnerships to help create opportunities that benefit the citys diverse residents.

Send Application and Fee to.

How Does Cincinnati S Tax Abatement Work Buildcollective Com

337 Oregon St Cincinnati Mt Adams Oh 45202 Mls 1516570 Townhouse Exterior Townhouse Designs Luxury Townhouse

Saxon At Villages Of Daybreak Spacious Living Cozy Room Custom Homes

How Tax Abatement Works In Cincinnati Oh Redknot Homes

Property Tax Working Group City Planning

Cincinnati S New Residential Cra Tax Abatement Green Cincinnati Education Advocacy

82 Twin Lakes Dr Fairfield Oh 45014 Twin Lakes Community Park Bath Map

Southwest Philadelphia Notable Here A Corner Lot Typically The Most Prime Real Estate On The Block T Best Vacation Destinations Wildwood Nj The Neighbourhood

Three Story Townhouse In Lincoln Park 975 000 Townhouse Exterior Townhouse Designs Townhouse

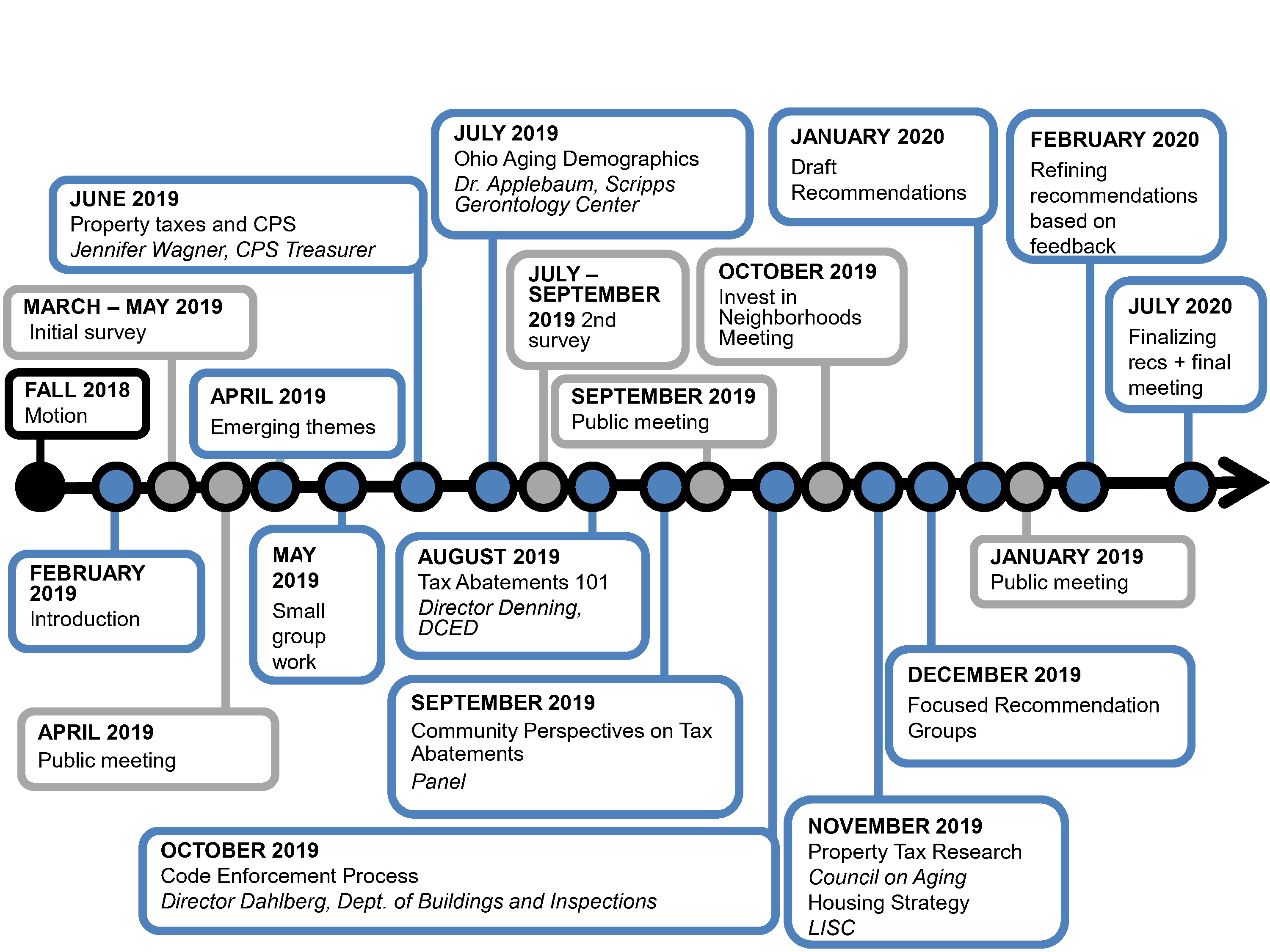

Tax Abatement Research Action Tank

Tax Abatement Research Action Tank

The Cincinnati Tax Abatement Is Changing Here S What You Need To Know Buildcollective Com

Tax Abatement Research Action Tank

335 Ashley Ln Wyoming Oh 45215 Wyoming Tudor Style Homes Real Estate